WHY APARTMENTS?

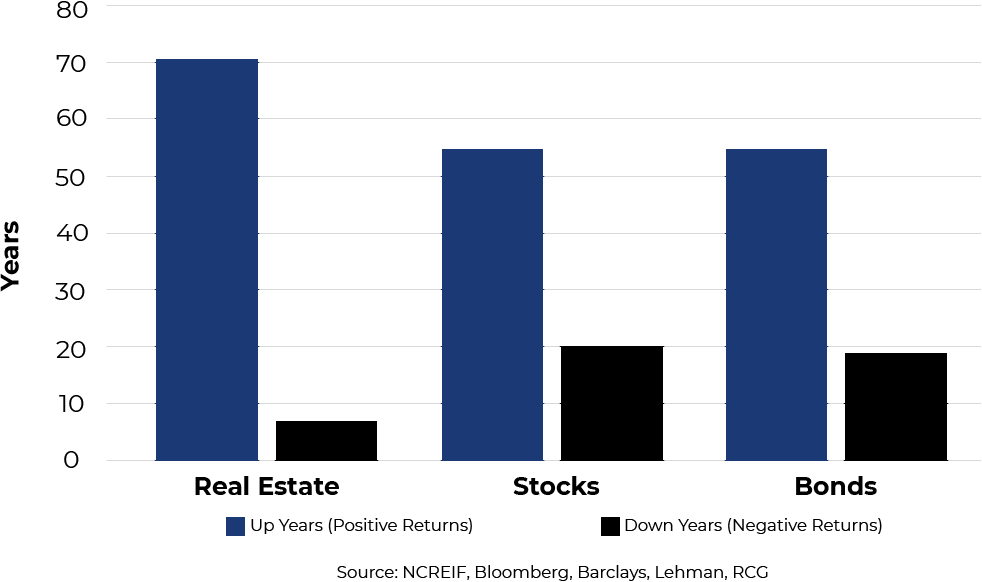

Historically, apartments have outperformed stocks & bonds.

If you want to avoid high-risk investments, investing in apartments is an intelligent choice. Multifamily investments can produce monthly income that is larger than that of stocks and bonds, making them an even better alternative if your goal is to maximize profits while limiting risk in your portfolio.

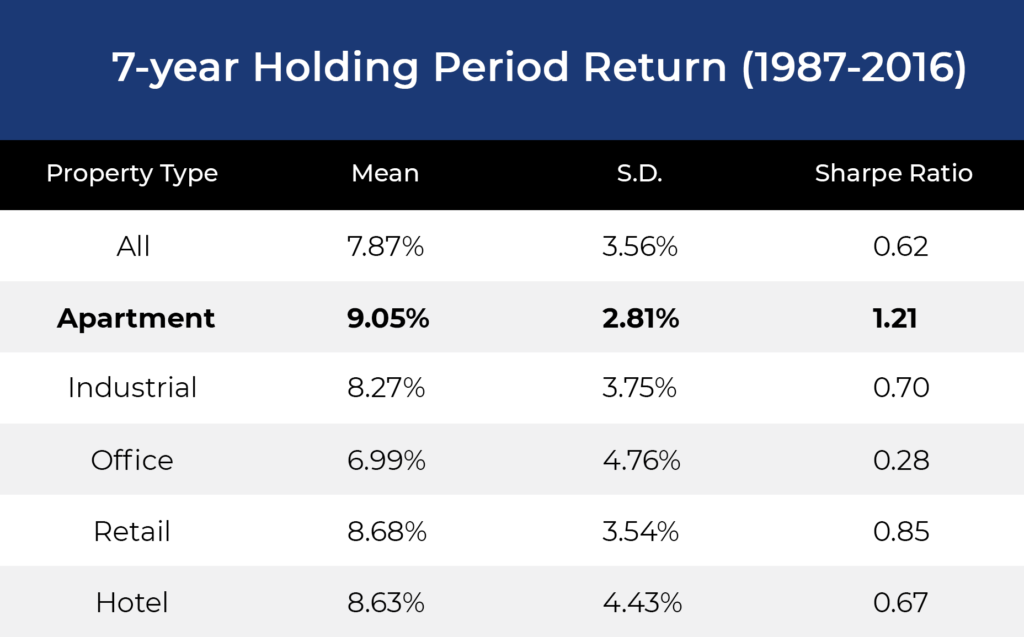

Apartments have historically outperformed other real estate asset classes.

Apartments have also shown to be the finest investment among all other types of real estate. We are able to achieve considerable cashflow and equity growth due to the nature of multifamily properties and the way we structure our investment assets, generating higher total returns than any other real estate asset classes.

Take Advantage of Increased Tax Benefits

Our team only invests in apartment buildings that are stable (above 80% occupancy) and cash flow positive. This enables our investors to earn significant returns while still reporting a loss at the end of each year.*

Take advantage of 3 types of depreciation that allow investors to lower taxes:

✔ Standard or Straight-line Depreciation

✔ Accelerated Depreciation

✔ Bonus Depreciation

All of our assets are subjected to cost segregation analyses, and the tax benefits are passed on to our investors via annual year-end reporting on K1s issued the previous year.

* Please speak with your tax advisor

Apartment demand is at an all-time high and continues to rise.

Homeownership has been steadily declining since the mid-2000s, and it will continue to decline as millennials and elderly baby boomers seek to remain mobile in the twenty-first century. The need for apartments is at an all-time high, and the population is continuing to grow, driving up the desire for apartment living. Low vacancy rates mean more cashflow and equity growth for our investors, which translates to higher profits.

OUR SERVICES

We provide a complete investment offering, from asset identification to asset exit

Asset Management

We excel at asset management – with frequent reporting as well as checking-in on assets, we ensure the asset performs and allows us to accomplish our business plan for investors. This allows us to achieve or exceed our projections, helping us maintain our high investor satisfaction.

Asset Rehab

To achieve our returns, several of our deals are value-add plays with a rehab component. With our proven track record, we manage these rehabs in-house ‘included with’ our asset management, saving our investors both costs and risk.

IF YOU ARE A BROKER, WITH A PROPERTY TO SELL, OR AN OWNER THAT WANTS TO SELL YOUR PROPERTY, TELL US ABOUT IT!

IF YOU ARE AN INVESTOR, INTERESTED IN HEARING MORE, OR GETTING ON OUR MAILING LIST, TELL US ABOUT YOURSELF!

SUBSCRIBE TO OUR NEWSLETTER!

CONTACT US:

7901 4th Street N, Suite 300

St. Petersburg, Florida 33702